Investment Analysis Competitions

- Participating in investment analysis competitions offers numerous benefits. Firstly, it provides an opportunity to apply theoretical knowledge to real-world situations, honing analytical and critical thinking skills. Secondly, it allows individuals to gain exposure to the financial industry, potentially leading to career opportunities or internships. Additionally, competitions offer a chance to network with industry professionals and other participants, expanding one's professional circle. Finally, winning or placing in a competition can enhance one's resume and improve their chances of securing future employment. Overall, investment analysis competitions offer a unique and valuable experience for individuals interested in finance and investment.

- The Department of Finance is responsible for selecting representative teams to participate in the following three competitions. For each competition, three teams will be chosen. Applications for each competition will open in late August, with interview sessions scheduled for September. Details regarding the application process will be provided in early August.

-

-

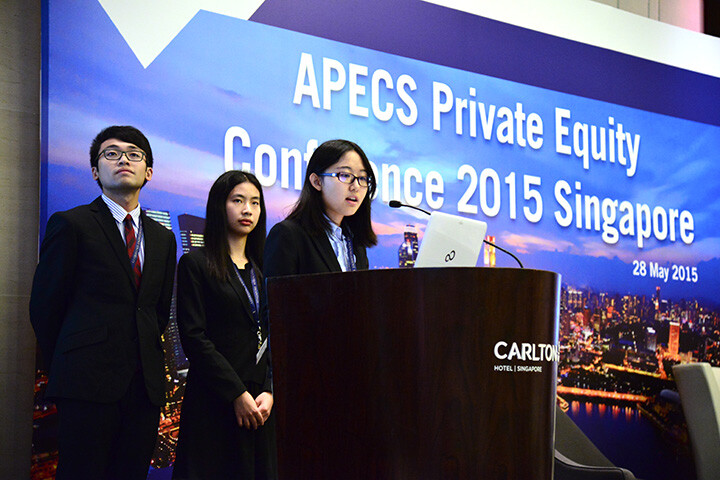

CFA Institute Research Challenge: The CFA Institute Research Challenge is a yearly global competition that offers university students hands-on mentoring and intensive training in financial analysis and professional ethics. Students are evaluated on their analytical, valuation, report writing, and presentation skills, and are given the opportunity to assume the role of a research analyst, gaining real-world experience.The CFA Institute Research Challenge is an annual global competition that provides university students with hands-on experience in equity research.

-

CQA Investment Challenge: The CQA Investment Challenge by the Chicago Quantitative Alliance is an equity portfolio management competition that offers students the opportunity to gain practical experience in stock selection and portfolio management through a simulated hedge fund experience. Participants will have the chance to act as portfolio managers, managing money, explaining their investment process, and discussing performance.

-

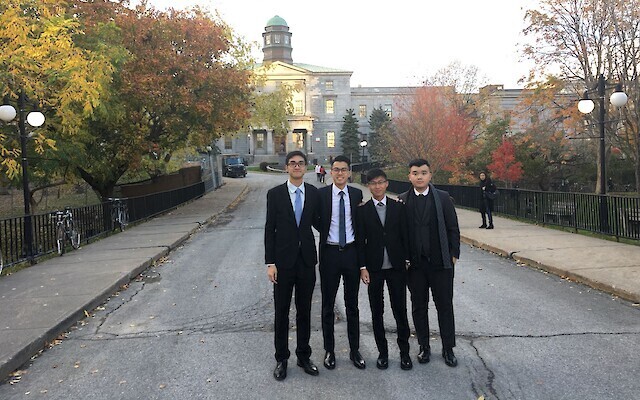

McGill International Portfolio Challenge: The McGill International Portfolio Challenge, which is part of McGill's Sustainable Growth Initiative, has become a knowledge forum that bridges the gap between academic knowledge and industry practices. Every year, hundreds of investors, actuaries, academics, and university students from diverse backgrounds come together to participate in the case competition, speaker series, and various recruitment activities. The MIPC addresses a new grand challenge each year, and the dedicated student executive team curates a rich and interactive experience for all stakeholders. The competition consists of multiple rounds, with the top-performing teams advancing to the final round to present their findings to a global audience in Canada.

-

-

Furthermore, there are various other investment competitions that enable students to apply their investment analysis skills to real-world data, providing valuable hands-on experience. These competitions include:

-

-

Value Investment Proposal Competition: The Value Investment Proposal Competition, organized by the Lau Chor Tak Institute of Global Economics and Finance and sponsored by Overlook Investments Ltd., provides undergraduate students with a distinctive opportunity to learn value investment techniques from leading industry experts and apply this knowledge in a competitive environment. Participants are required to attend a series of lectures and then submit an investment proposal.

-

FOAHK Case Competition: The Family Office HK case competition aims to provide students with a deeper understanding of how family offices operate, respond to increasing regulations and industry awareness in Green and Sustainable Finance, and explore potential career opportunities within the family office ecosystem, including private banking, investment banking, asset management, and FinTech.

-

HKSII Case Competition: The Hong Kong Securities and Investment Institute offers the Case Competition to university students as a means of fostering their career development in the financial industry. The Case Competition 2023 is available to all full-time undergraduates from 19 eligible higher education institutions in Hong Kong, as well as selected universities in the Greater Bay Area.